Nova Scotia Economic Outlook 2025: Trade, Housing, Jobs, and Growth

Nova Scotia economic outlook 2025 is showing modest growth, underpinned by trade developments, housing recovery, labor market trends, and commodity production. Despite national and provincial challenges, opportunities exist across goods-producing industries, construction, and government-backed initiatives. In this analysis, we explore trade and exports, housing trends, labor market performance, and provincial growth drivers.

Trade and Exports

Canadian exports dipped in the second quarter, following a strong surge to the U.S. in the previous quarter. Lower-than-expected tariffs have marginally improved the outlook for trade. Provinces like Quebec, Saskatchewan, and Alberta have underperformed nationally, while Ontario, Alberta, Newfoundland, and PEI show limited promise in export diversification.

Nova Scotia has aggressively reduced interprovincial trade barriers, positioning itself to offset some U.S.-Canada trade disruptions. Ontario leads in removing barriers, followed by Nova Scotia, Manitoba, B.C., and PEI. Newfoundland and Labrador, along with New Brunswick, remain more cautious. Geographic and agreement gaps persist, but provincial efforts should provide measurable support to the local economy.

Housing Trends

Canada’s housing market continues to recover. B.C. and Ontario show strong pent-up demand, although loose conditions restrain price gains. Other regions, including the Atlantic provinces, Prairies, and Quebec, are expected to see mid-to-high single-digit price growth in 2025 and 2026.

Nova Scotia benefits from housing-driven stability. While overall economic growth slows, housing activity is likely to support the local services sector, including finance and insurance, which showed cooler performance in early 2025.

Labor Market

Canada’s job market shed over 100,000 positions, pushing unemployment to a cyclical high. Ontario absorbed the shock disproportionately, but national rates should drift lower as employment recovers slightly. Population growth stagnation limits labor force expansion, stabilizing unemployment at approximately 6.5% in Nova Scotia.

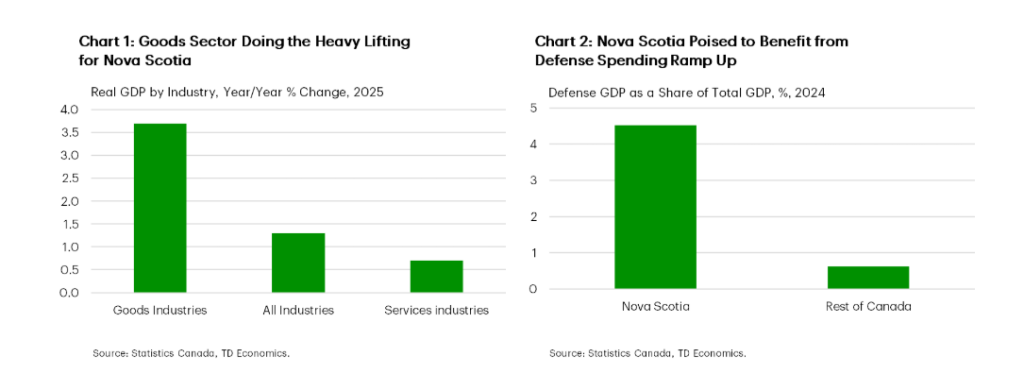

Public sector hiring remains subdued, reflecting provincial budget moderation. Despite this, federal defense spending and the province’s military presence provide additional employment support.

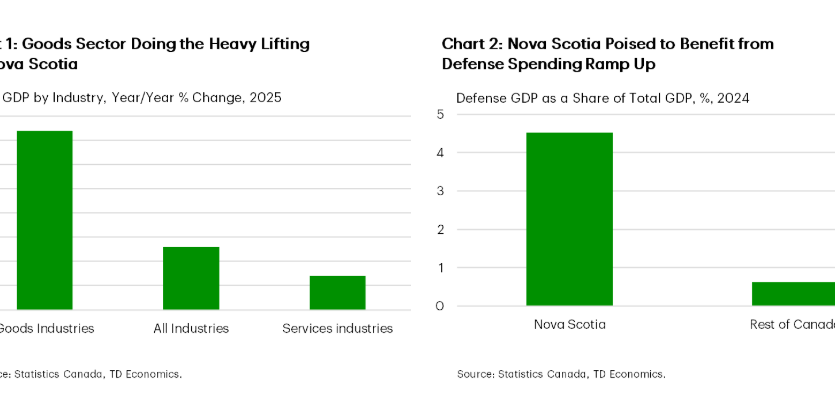

Goods and Commodity Production

Nova Scotia’s goods sector remains strong despite tariffs on seafood exports to China. Manufacturing has been resilient, boosted by tire production. While July sales declined slightly, moderate growth is expected in line with U.S. economic trends and domestic trading partners.

Commodity production in Alberta, B.C., and Saskatchewan also continues to support national growth. Crude oil prices softened, but broad-based recovery is anticipated in 2026.

Construction and Investment

Construction activity in Nova Scotia is robust. Residential growth benefits from significant rental development, while non-residential projects, including large hospital constructions, maintain momentum.

Looking forward, the $60 billion Wind West megaproject could supply nearly 30% of Canada’s energy needs. This offshore wind project promises large-scale construction activity, infrastructure investment, and long-term economic benefits for the province.

Conclusion

Nova Scotia economic outlook 2025 faces slower growth, primarily driven by services and population trends. However, robust manufacturing, housing recovery, trade improvements, and major construction projects provide support. Policy measures, federal spending, and infrastructure development signal optimism for continued stability and measured growth in the province.